Reform PILOT Agreements in Schenectady

Why This Matters

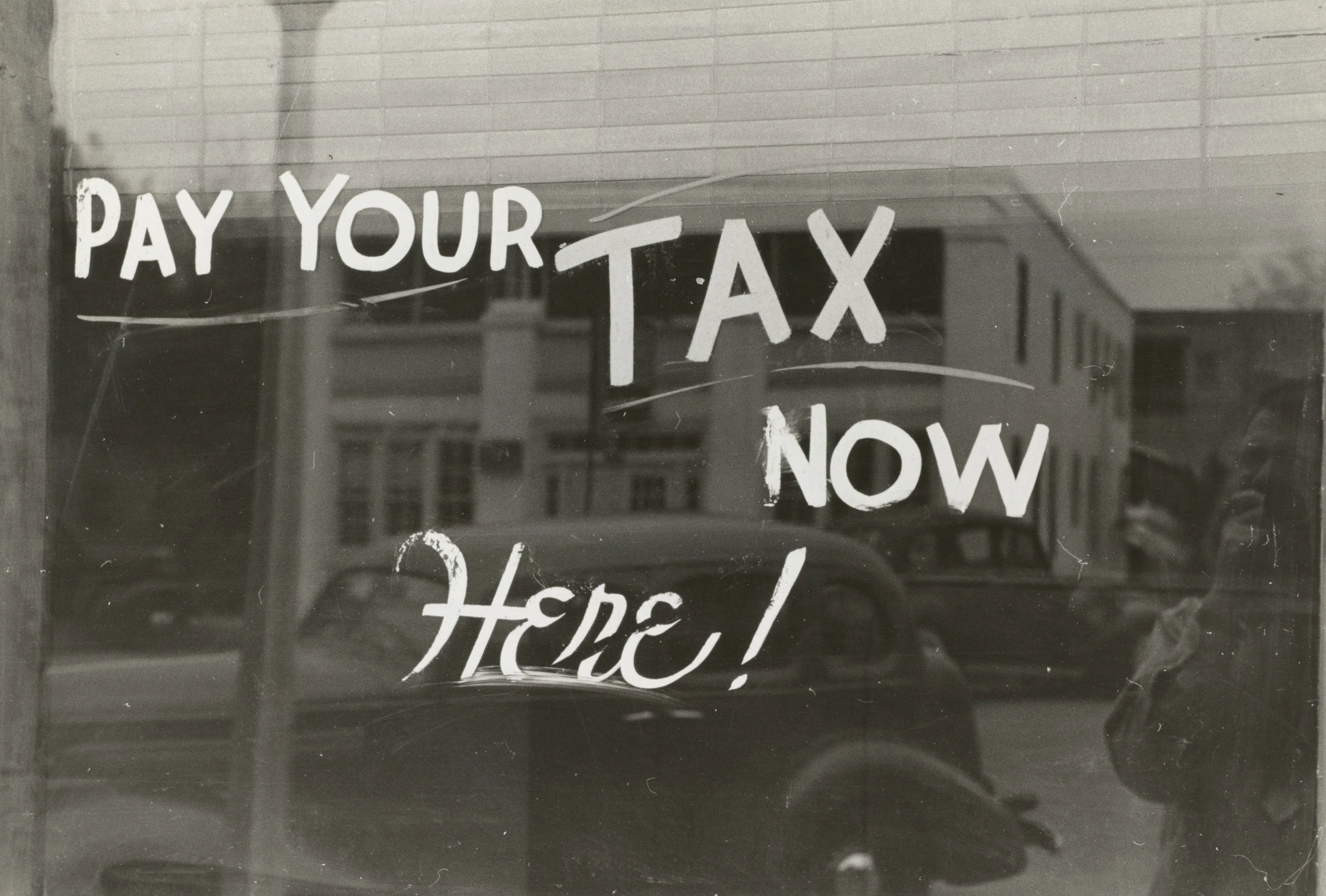

PILOTs Payments In Lieu Of Taxes were created as temporary tools to encourage development. Over time many have turned into permanent tax breaks that shift the tax burden onto homeowners renters and small businesses.

When large developers and institutions avoid full taxation everyday residents are left paying more. That is not economic development. It is cost shifting.

Schenectady needs PILOT reform that puts the public first.

The Policy End Permanent Tax Breaks

This policy ensures every PILOT is temporary measurable and accountable.

All PILOT agreements must

Be time limited with a clear end date

Deliver documented public benefits

Transition to full taxation

Undergo public review before approval or extension

No PILOT exists forever.

What PILOTs Must Deliver

Any project receiving tax relief must provide real value to the community including

Local job creation with fair wages

A meaningful increase to the tax base after expiration

Affordable or mixed income housing commitments

Infrastructure improvements paid for by the developer

Benefits that clearly serve Schenectady residents

Public investment requires public return.

Mandatory Expiration and Review

Every PILOT will include

A fixed expiration timeline

A mid term public performance review

A clear path to full tax responsibility

There will be no automatic renewals and no quiet extensions.

Transparency and Public Oversight

City Hall will

Publish a public list of all active PILOT agreements

Show how much tax revenue is being waived

Report what each project promised versus what it delivered

Require public hearings for approval or extension

If residents are subsidizing a project they deserve to know it.

Who Is Typically in PILOT Agreements

While agreements change over time PILOTs most often include

Large real estate developers

Corporate commercial properties

Hotels and entertainment venues

Luxury or market rate housing projects

Quasi public authorities and affiliated entities

Major institutional landholders

These agreements can involve millions in forgone tax revenue over many years.

Why Reform Is Necessary

PILOT systems often benefit politicians more than residents by allowing deals without long term accountability and shifting tax pressure quietly onto families.

Reform replaces insider advantage with clear rules and public benefit. PILOTs should be temporary tools not permanent entitlements.

This policy ensures development pays its fair share protects homeowners and renters and builds a stable tax base for the future.

That is how Schenectady starts Chenecting fairness accountability and real economic growth.